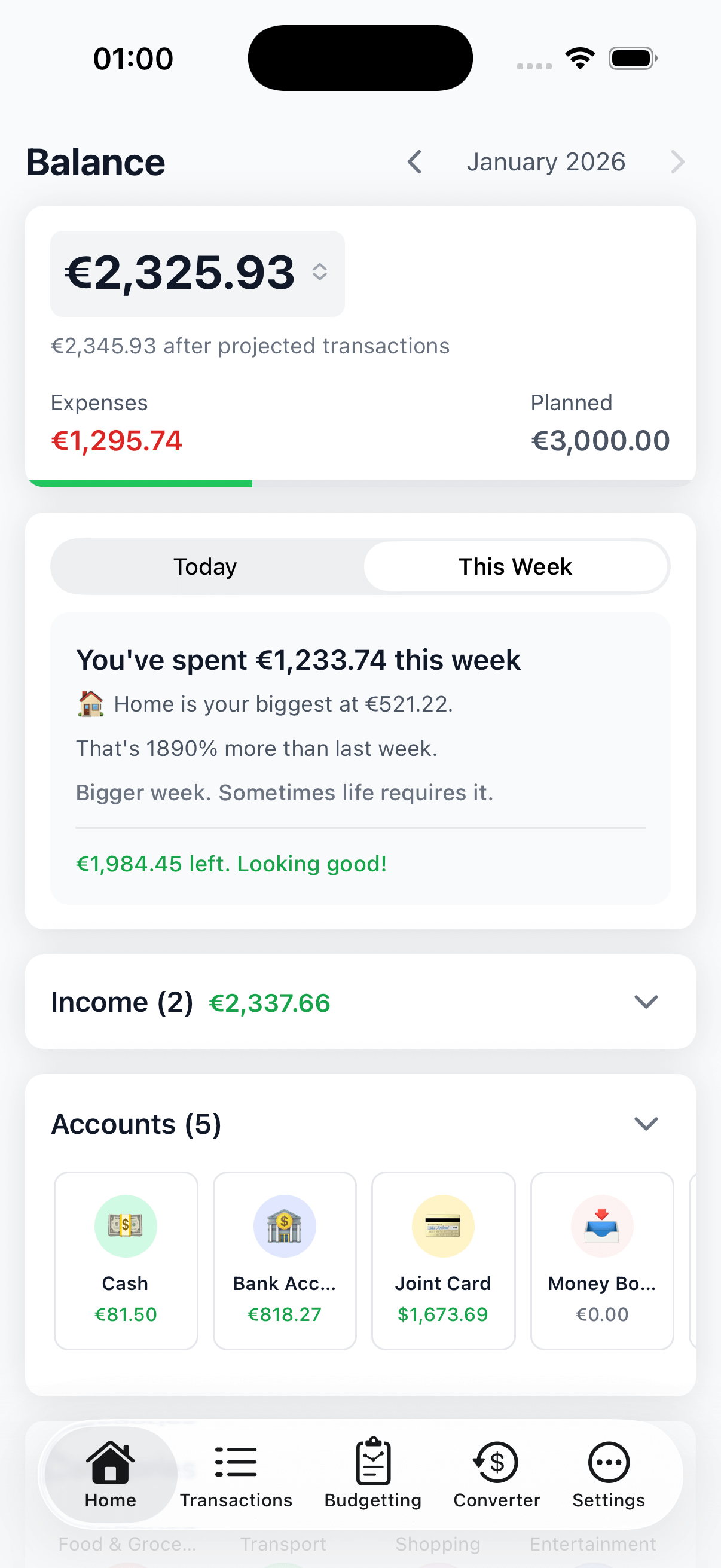

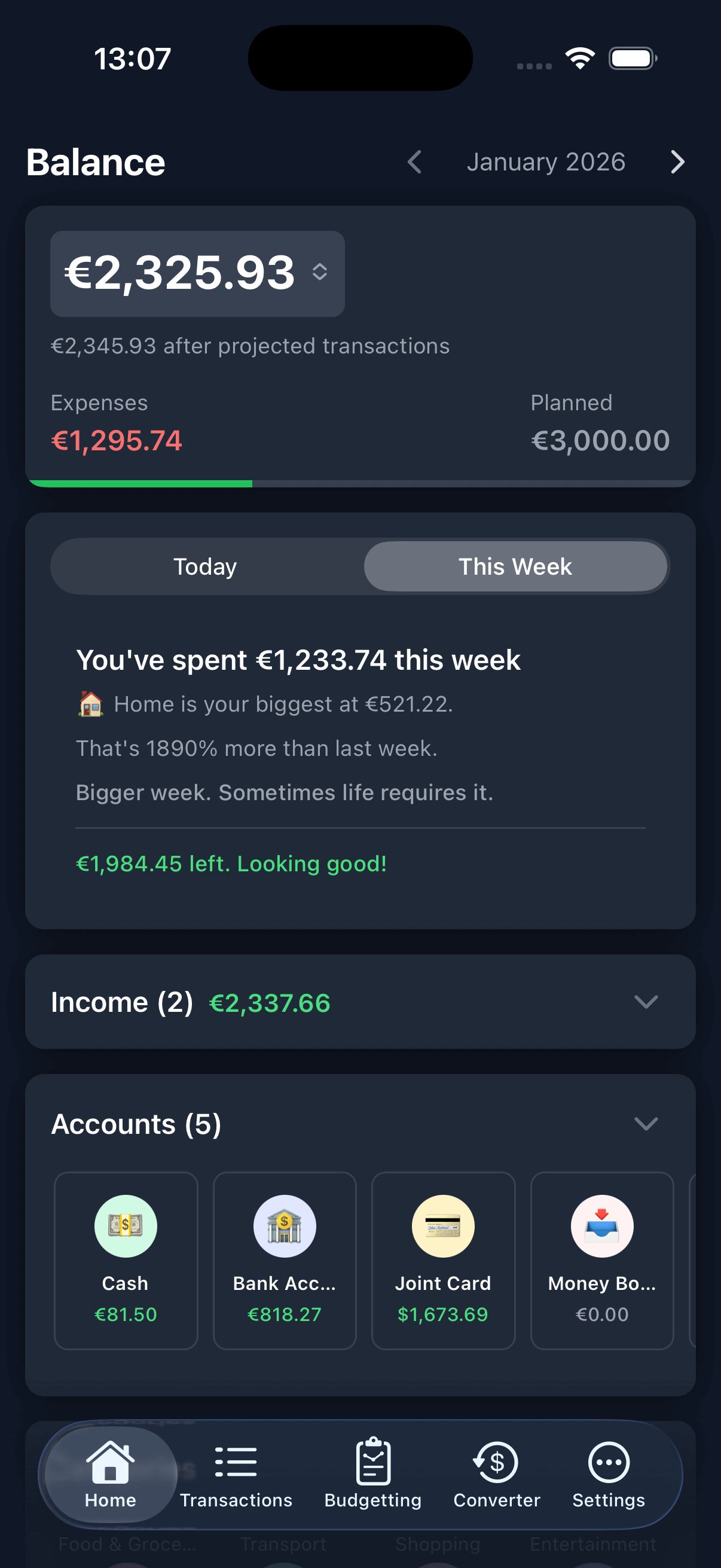

Clarity, with ease.

You don't need to learn the app. Just track your spending and it tells you where you stand.

So simple you'll actually keep using it.

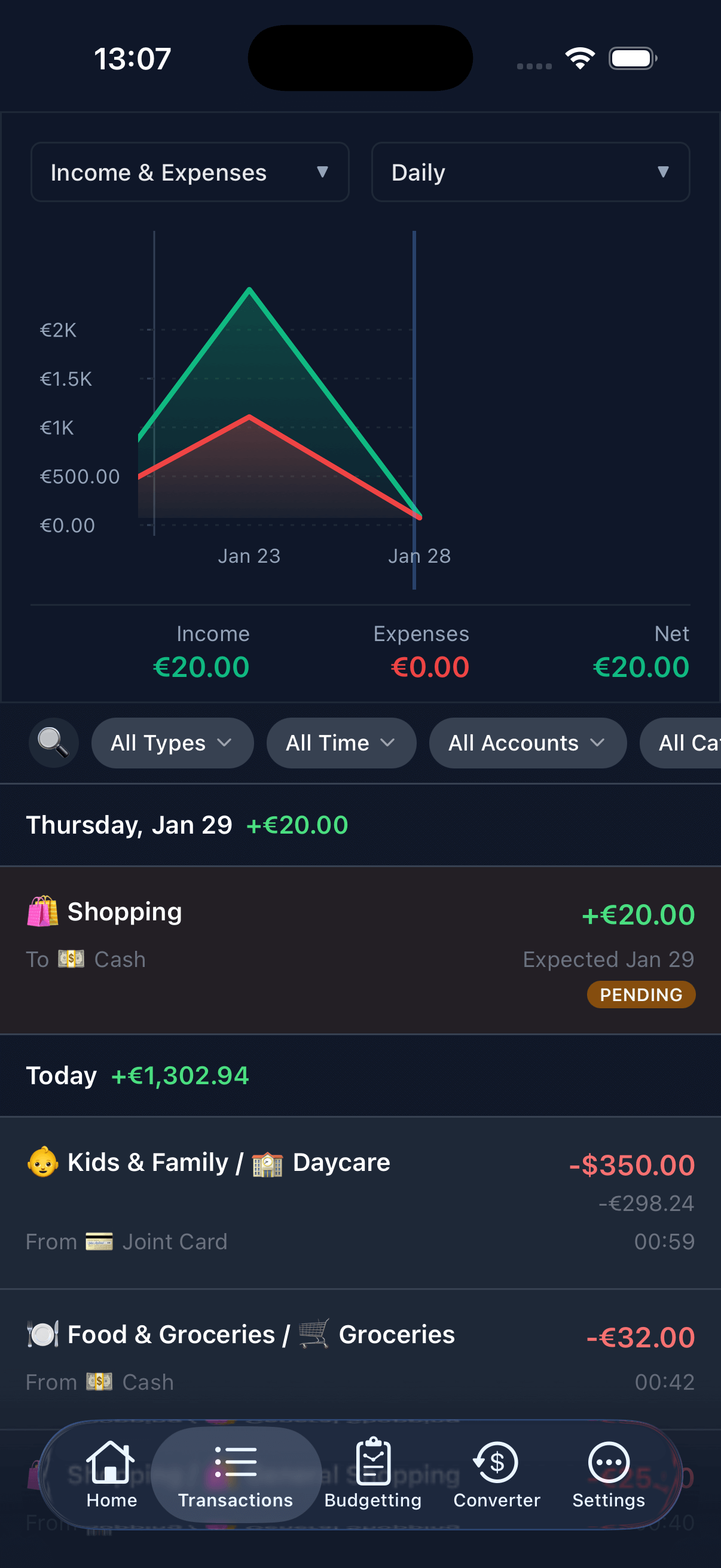

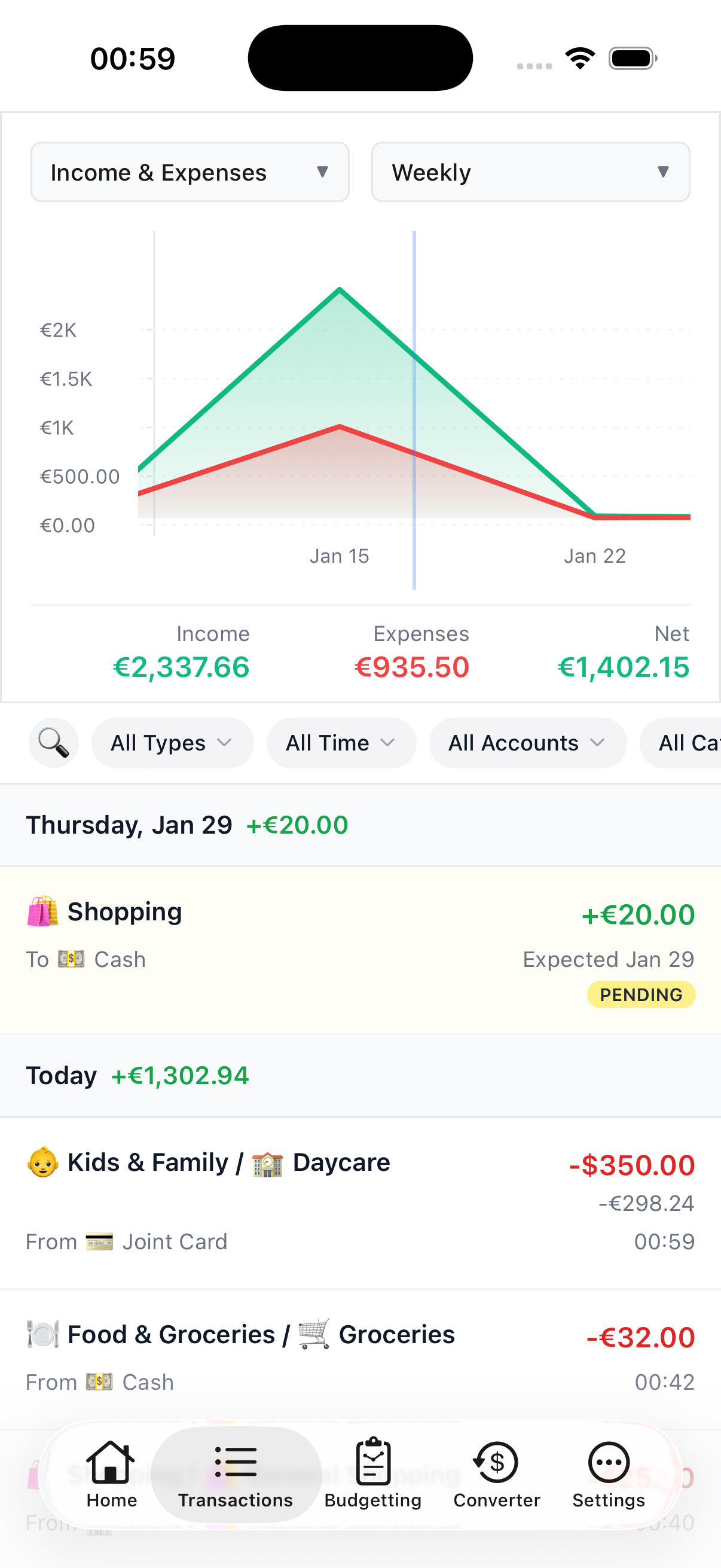

Your spending story, visualized.

Track income and expenses over time with beautiful charts. Filter by type, date, account, or category to find exactly what you need.

Money management is hard. Family budgeting can be a nightmare.

We built WithinBudget because most budgeting apps felt like work. Too many settings. Too many screens. Too much pressure to be 'perfect.'

Real life doesn't run on perfect categories. You're busy. You're spending fast. And when tracking becomes complicated, it's the first thing people drop—then the stress comes back.

So we built a calmer alternative: fast manual tracking that gives you clarity, with friendly messages that keep you steady—not guilty.

You can keep it simple forever. Or go deeper when you're ready—budgets, goals, subscriptions. Your pace, your rules.

Built around benefits, not busywork.

Stay in control without overthinking

WithinBudget keeps the daily flow simple. You always know where you stand—without living inside charts and settings.

Manual entry that makes spending more mindful

A quick log creates a tiny pause. It's not about restriction—it's about awareness. And awareness changes everything.

Plan ahead when you want to

Budgets, goals, subscriptions, and scheduled transactions are there when you're ready—but never required.

The features you actually use.

Everything is designed to reduce friction and increase clarity.

Advanced search

Find any transaction in seconds—by category, account, notes, date range, or amount.

Subscription tracking

See what's recurring, what's due, and what quietly adds up over time.

Scheduled & recurring transactions

Plan bills, rent, paydays, and repeat purchases without mental load.

Refunds that stay tidy

Track refunds cleanly so your totals remain clear and trustworthy.

Built-in currency converter

A dedicated converter screen when you need a quick answer right now.

33 supported currencies

Perfect for travel, expats, and anyone dealing with more than one currency.

Family sharing changes everything.

Stop guessing. Stop awkward 'are we okay this month?' talks. See the same picture and plan ahead together.

Private by design

No bank credentials required. Optional protections when you're out and about.

Lock the app with Face ID / Touch ID

Blur balances for privacy in transit

Works offline—track anywhere

Your data stays on your device

Simple Premium, only if you need it.

Start free. Upgrade when it genuinely helps—especially for families and planning ahead.

$0

Everything you need to start tracking

- Unlimited transactions

- 33 currencies with conversion

- 4 accounts (checking, savings, cash, credit)

- Unlimited budgets and goals

- Full offline functionality

$3.99 / month

For families and power users

- Cloud sync across devices

- Family sharing with real-time updates

- Unlimited accounts

- Unlimited income streams

- Priority support

No trial. No pressure. Upgrade when it adds value.

What people say after they finally stick with tracking

It's the first budget app that feels simple enough to use every day. No drama—just clarity.

Early user

Family sharing made the biggest difference. We stopped guessing and started planning.

Early user

I love that it doesn't judge me. It just helps me stay on top of things.

Early user

FAQ

Yes. The core flow is: open the app → tap a category or account → type the amount → done.

Because it creates awareness. Auto-sync often becomes passive and messy. Manual tracking is quick, mindful, and keeps you connected to your spending.

No. You can keep it simple forever. Budgets, goals, and subscriptions are there if you want more planning later.

Everyone sees the same picture. It turns 'guessing and hoping' into 'knowing and planning'—without bank password sharing.

We don't require bank credentials. You can lock the app with Face ID / Touch ID and blur balances for privacy in public.

33 currencies—enough for most travel and multi-country life.